Can Be Used for Firms Which Have Negative Growth Rates

The stock valuation model P0 D1rs- g cannot be used for firms that have negative growth rates. A substantial rise in interest rates can have a negative effect on some industries.

Pin By Anil Wijesooriya On Leadership Leadership Insight Inbox Screenshot

The price of a stock is the present value of all expected future dividends discounted at the dividend growth rate.

. A third approach to estimating earnings growth is to use fundamentals. Three variables are included in the Gordon Growth Model formula. The dividend yield on a constant growth stock equals its expected total return less its expected capital gains yield.

Negative Growth in an Economic Context. Reported ROE was equally dismal at -51. B The stock valuation model P0 D1 rs - g can be used to value firms whose dividends are expected to decline at a constant rate ie to grow at a negative rate.

The constant growth model cannot be used for a zero growth stock where. The sustainable growth rate SGR is the maximum rate of growth that a company can sustain without having to finance growth with additional equity or debt. Think of it this way.

The stock valuation model P0 D1 rs - g can be used for firms which have negative growth rates. A countrys economy can experience negative growth when its gross domestic product GDP Gross Domestic Product GDP Gross domestic product GDP is a standard measure of a countrys economic health and an indicator of its standard of living. The preemptive right gives stockholders the right to approve or disapprove of a merger between their company and some other company.

Cannot be used for firms that have negative If a company has two classes of common stock Class A and Class B the stocks may pay different dividends but under all state charters. The constant growth model cannot be used for a zero growth stock where the dividend is expected to remain constant over time. If a stock has a required rate of return ks 12 percent and its dividend grows at a constant rate of 5 percent this implies that the stocks dividend yield is 5 percent.

The stock valuation model P0 D1rs - g cannot be used for firms that have negative growth rates. The stock valuation model P0 D1 rs - g can be used for firms which have negative growth rates. The stock valuation model P0 D1rs g can be used to value firms whose dividends are expected to decline at a constant rate ie to grow at a negative rate.

The price of a stock is the present value of all expected future dividends discounted at the dividend growth rate. Declining wage growth and a contraction of the money supply are characteristics. If a stock has a required rate of return rs 12 percent and its dividend grows at a.

50 -1 -25 25. You have too think of it in terms of algebra. The answer to your problem is 100 growth.

Vops FCF1 WACC growth rates. This approach is also difficult to apply for firms that have negative earnings since. You need to multiply the -25 by negative 1 converting the -25 to a 25 and then subtract from 50 and divide by 25.

Earnings growth rates cannot be estimated or used in valuationThe first and most obvious problem is that we can no longer estimate an expected growth rate to earnings and apply it to current earnings to estimate future earnings. If a company has two classes of common stock Class A and Class B the stocks may pay. However free cash flow generation for the year was positive.

The stock valuation model P0 D1rs g can be used to value firms whose dividends are expected to decline at a constant rate ie to grow at a negative rate. The stock valuation model P0 D1rs g cannot be used for firms that have negative growth rates. C If a stock has a required rate of return rs 12 and its dividend is expected to grow at a constant rate of 5 this implies that the stocks dividend yield is also 5.

When current earnings are negative applying a growth rate will just make it more nega-tive. The stock valuation model P0 D1rs g can be used to value firms whose dividends are expected to decline at a constant rate ie to grow at a negative rate. For example if rates rise too quickly auto manufacturers might suffer from lower sales since many consumers.

The stock valuation model P0 D1rs- g can be used only for firms whose growth rates exceed their required return. For most firms this negative reinvestment rate will be a temporary phenomenon reflecting lumpy capital expenditures or volatile working capital. For firms with negative earnings in the current period this estimate of a growth rate will not be available or meaningful.

The stock valuation model P0 D1rs - g cannot be used for firms that have negative growth rates. Is often used as the expected growth rate in valuation. If a stock has a required rate of return rs 12 percent and its dividend grows at a constant rate of 5 percent this implies that the stocks dividend yield is 5 percent.

WACC WACC is a firms Weighted Average Cost of Capital and represents its blended cost of capital including equity and debt. The stock valuation model P0 D1 rs - g can be used to value firms whose dividends are expected to decline at a constant rate ie to grow at a negative rate. 1 D1 or the expected annual dividend per share for the following year 2 k or the required rate of return.

The reinvestment rate for a firm can be negative if its depreciation exceeds its capital expenditures or if the working capital declines substantially during the course of the year. Also GDP can be used to compare the productivity levels between different countries. The equation looks like this.

The stock valuation model P0 D1 ks - g can be used for firms which have negative growth rates. -25 to 0 is 25 and 0 to 50 is another 25. These charges resulted in a negative net income of 127 billion or negative 641 per share.

The free cash flow valuation model Vops - FCF1 WACC - B can be used only for firms whose growth rates exceed their WACC The free cash flow valuation model. Companies with high SGRs are usually. The stock valuation model P0 D1rs - g can be used for firms whose growth rates exceed their required return.

If the company has 50 million shares outstanding each share would be worth 24566 million 50 million shares 491 to keep things simple we assume the company has no debt on its balance. Negative growth is a decline in a companys sales or earnings or a decrease in an economys GDP during any quarter. And 3 g or the expected dividend growth.

Negative P E Ratio Scheduled Via Http Www Tailwindapp Com Utm Source Pinterest Utm Medium Personal Finance Organization Finance Meaning Fundamental Analysis

How The World Economy Will Grow Through 2024 Country By Country Map World Map Country Maps

How Happy Employees Can Lead To A Happy Company Infographic Happy Employees Business Leadership Infographic

Wells Fargo Smb Svp Sean Mabey On The Minimum Wage School For Startups How To Start A Business Minimum Wage Start Up School

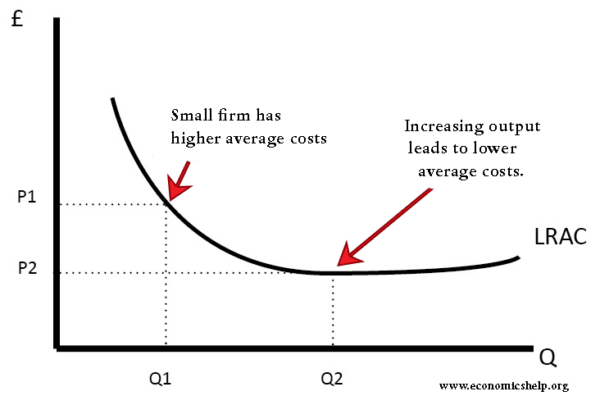

Discuss Why Firms Grow In Size Economics Help

Is Impact Of Economic Growth On Business Any Good 10 Ways You Can Be Certain Impact Of Economic Growth On Business Business Benefits Growth Business Impact

Personal Swot Analysis Swot Analysis Analysis Swot Analysis Template

Cash Sweep Helps You Pay Debt Or Earn Higher Interest Cash Sweep Accounting And Finance Accounting

The Theoretical Economic Cycle Output Gap And Inflation Accounting And Finance Structured Finance Investing

Infographic Trinidad Tobago Road To Recovery Tobago Trinidad Trinidad And Tobago

5 Advantages Of Negative Gearing Positive Cash Flow Positivity Negativity

18 Marketing Stats To Guide Your Business Strategy In 2020 Infographic Marketing Digital Marketing Infographics New Years Resolution

Pin On Numerology December 2018

Growth Of Firms Intergation Mergers Takeovers Internal External Growth Business Studies Economics Lessons Private Sector

Social Media Is Something That Everyone Uses Nowadays And Its Omnipresence Has Adversely Affected The Lifestyle That Most Of T Work Culture Infographic Culture

The Biggest Lie In Buy Negative Google Reviews Start Up Business Business Branding How To Introduce Yourself

Comments

Post a Comment